Key takeaways

- Latest market downturn: This is the latest market downturn, triggered by unexpectedly severe tariff impositions by US President Trump.

- Pullbacks are normal: Don’t be alarmed by market dips; they are a natural part of investing.

- Avoid locking in losses: Selling shares after a fall crystallizes the loss.

- Timing is futile: Trying to predict market peaks and troughs is extremely difficult.

- Opportunity in pullbacks: Lower prices offer opportunities to buy quality assets at a discount.

- Income generation: Shares can provide an attractive income stream through dividends.

- Tune out the noise: Focus on your long-term strategy and avoid being swayed by short-term market chatter.

Volatility in share markets has spiked with major sell offs following US President Trump’s ‘liberation day’ tariff announcements last week.

Markets have already bounced back after yesterday’s carnage.

Let’s take a look at what’s happening and why, and what this means for investors.

What’s happening and why?

- Trump imposed reciprocal tariffs on all countries exporting to the US, with a minimum of 10% for all countries, with the major economies of China and Europe receiving 34% and 20% tariffs.

- Over 60 countries that trade with the US received these tariffs.

- It is unclear what the purpose of the tariffs will be, whether these are to be used as strong arm negotiation tools for the US, or if Trump wants to make these permanent.

- These announcements were far and above in severity to the expectation of markets, causing a rout on share markets since the announcement.

What’s a tariff?

A tariff is a tax put on goods that are imported from outside of the US into the US, which is paid by the importer. Example:

- A US T-Shirt company has its T-shirts manufactured in China for $10 per shirt and imports them to sell in the US.

- The tariff on Chinese imports is 34%, which means the US importer needs to pay 34% tax in addition to the cost of the t-shirt, which increases the cost from $10 per shirt to $13.40 per shirt.

- Either the US importer needs to sell the t-shirts to its customers with a higher price to pay for the tariff, or the US importer needs to accept a lower profit.

The idea with tariffs is to make it less attractive to import goods from overseas and control certain industries to try and make them produce goods in the US over the long term.

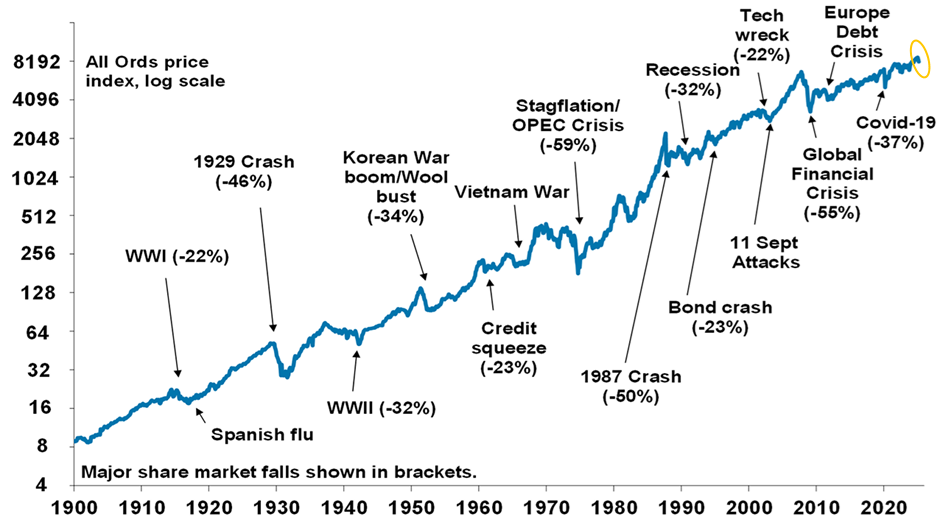

Share market falls

Our share market has fallen rapidly, down -9.2% from April 2nd (tariff announcements) to the close of trading on April 8th. In total, from our share market’s high in mid-Feb, our market is down approx. -15%.

Viewed in isolation, it would appear to be worrying, however we can see in the history of our share market, these drawdowns (falls in the share market) are common and vary in severity. The current pullback is small in comparison.

Source: AMP, ASX, Bloomberg.

Market pullbacks are normal

Market pullbacks and falls in value are normal and healthy.

As investors, a long term focus is key to navigating these falls, as they are generally short term and overreactions.

Long-term growth prevails

History shows the share market recovers and grows over the long term, despite short-term fluctuations.

The share market always prevails in the long term. In its history over the last 120 years, we know there have been countless wars, economic crashes, terrorist attacks and even pandemics.

Source: AMP, ASX.

Each event causes a momentary blip in the growth of the share market, and over the long term, most become a distant memory.

What we think

As usual, we think the current pullback in share markets is a quick overreaction to a surprise.

It is likely that the US and Trump wants only to use these tariffs as strong arm negotiation tools to make deals that are more favourable to the US.

We’ve already seen that this tactic is working with the EU, with the EU trade commission openly stating that they want to negotiate with the US and have already offered ‘zero for zero’ tariffs.

In other economies, like China, they are responding with tariffs of their own, and we’ve seen Trump respond instantly with a threat of further 50% tariffs.

So, overthe short term future, it’s going to be volatile as the US administration navigates this and makes deals, but over the long term, the global economy will figure this out and reach a point of stability, as it always has.

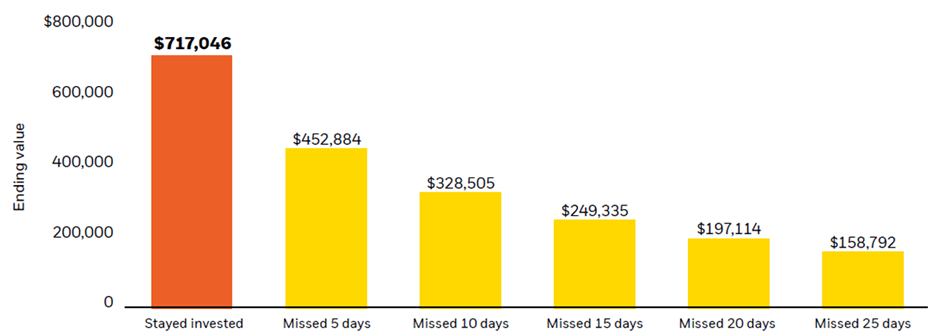

Stay the course

As with all share market pullbacks, they are temporary and staying invested and tuning down the noise of the latest event is critical.

Avoiding emotional reactions and selling at a lower value locks in losses, and timing the market is difficult and proven to be impossible on a long term basis.

See below the impact of an investment of $100,000 in the US share market (S&P 500) over the last 20 years has, from just missing 5 days of the best returns, which happens when investors lock in losses by selling at a lower value:

Source: Futuro, BlackRock, Bloomberg.

We’re here to help

We know investing is stressful especially during these times where there are sudden pullbacks.

We’re here to support you in understanding what is happening in the market and to reassure you that staying invested will help you reach your long term investment goals.

At the time of writing this article, our share market is already rebounding, up over 1% in just the first 30 minutes of trade.

Please reach out to us if you have any concerns or questions, we are here to help.

General Advice Warning: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, Mandate Financial Planning and Futuro Financial Services Pty Ltd do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, Mandate and Futuro do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.