Despite an unbelievably eventful last month that initially shook markets, the subsequent strong rally shows how turning down the noise and staying the course is always best.

We’ve summarized the recent events and see promising signals towards cost of living relief and investment stability.

Key points

- Market recovery: Reduced political and economic uncertainty signals improved investment prospects for the remainder of the year, with the ASX200 up 12% since its April low.

- Australian market boost: Historical trends show the Australian share market typically rises post-elections.

- Interest rate cuts: Signals of up to 1.50% in total interest rate cuts in the next 12 months will great relief for mortgage holders.

- Trump’s tariffs: Initial US tariff threats triggered global market turmoil, followed by reversals and backflips as investors now understand how to navigate the world under Trump.

- Geopolitical shifts: A new American Pope’s focus on peace and conservative electoral setbacks in Canada and Australia indicate a potential shift away from “Trump-ism” and potential restoration of stability.

- Labor in Australia: Labor’s landslide election victory means a strong likelihood they remain in government for the next 6 years, with their policies set out in the recent budget to go ahead. Click here to see their key policies.

Resounding rebound in our share market

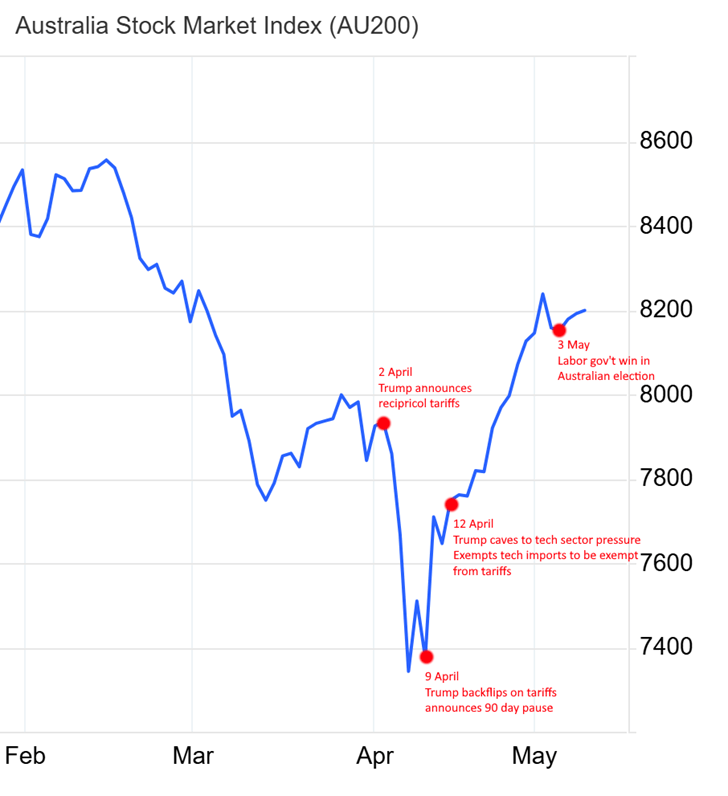

Source: ASX, Tradingeconomics

- The Australian share market (ASX200) hit a high on Valentine’s Day, then plunged nearly 15% by April, driven by Trump’s sudden tariff changes.

- Since then, a strong rally has occurred as investors adapt to the new global landscape under Trump.

- Following Trump’s tariff reversals and concessions to the tech industry, the ASX200 has recovered nearly all its losses, surging 12% since April’s low.

- Labor’s significant majority win is expected to stabilize the market, as the likelihood of continued government after the next election reduces political uncertainty.

- Anticipated rapid interest rate cuts will provide cost-of-living relief, further improving investment conditions.

Interest rate cuts of up to 1.50% predicted in the next 12 months

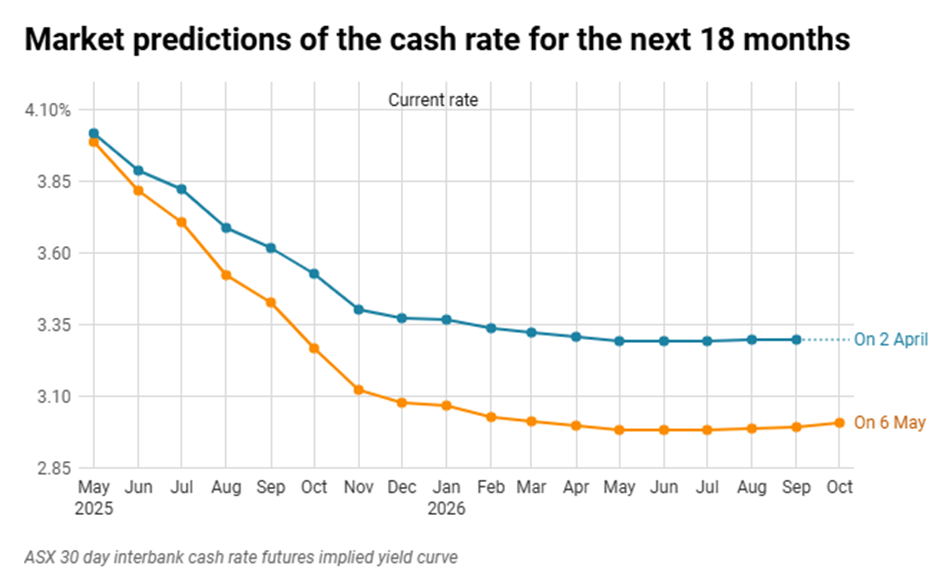

Source: ASX, Datawrapper

- The market now sees a greater than 50% chance of a large 0.50% interest rate cut at the upcoming RBA meeting on May 20th.

- Predictions for more frequent and larger rate cuts have increased in the last month, mainly due to the uncertainty seen in April.

- Major banks, including NAB, largely agree, with NAB forecasting a 0.50% cut soon, followed by four more 0.25% cuts by February next year.

- This could bring the total rate reduction to 1.50%, dropping the cash rate from 4.10% to 2.60%. For a $600,000 home loan, this could mean monthly savings of around $500, easing cost-of-living pressures and boosting the economy.

General Advice Warning: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, Mandate Financial Planning and Futuro Financial Services Pty Ltd do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, Mandate and Futuro do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.